Reasons to investinto crypto assets

The future of finance

During the last few years, it has become clear that cryptoassets are not just a passing fad. By now they form a new asset class that investors cannot afford to ignore. With major corporations, banks and even nations jumping on the bandwagon, the question is not whether the relevance of cryptoassets grows – the question is just how fast this will happen.

Return Potential

Im Blockchain-Umfeld wird ein Wert im jeweiligen System durch kryptographisch abgesicherte Coins oder Tokens repräsentiert. Der Inhaber dieser Tokens kann die jeweilige Blockchain bzw. deren Anwendungen nutzen. Tokens können gehandelt werden, die Preisfindung erfolgt über große internationale Online-Handelsplätze. Durch den Erwerb von Tokens können Investoren direkt an der Wertschöpfung des jeweiligen Blockchain-Systems und den darauf aufbauenden Anwendungen partizipieren.

Diversification

The correlation of cryptoassets with other asset classes is low, making them a great tool to diversify portfolios. This has been demonstrated during the recent market turmoil, when cryptoassets have exhibited positive returns when other markets experienced double digit declines. All rational investors should consider adding cryptoassets to their portfolios to reap the asset class’s diversification benefits.

Crypto assets:an attractivenew asset class

Cryptographically secured coins or tokens are called cryptoassets. They are ideal as an addition to portfolios of professional investors as they offer a unique combination of positive features.*

* Past performance is not a reliable indicator of future performance

Advantages of the fund

Regulated structure

The fund operates as an Alternative Investment Fund (AIF), which is a structure that is tried and tested with professional investors. All parties have in-depth know-how regarding cryptoassets.

Safe storage

The assets of the fund are segregated and are held by a regulated depositary. The Assets are predominantly kept in a so-called cold storage. This type of storage is designed to provide the highest level of security.

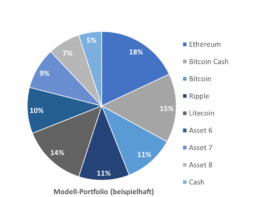

Diversified portfolio

The fund invests in a portfolio of individually selected cryptoassets, giving investors access to a diversified portfolio of cryptoassets. This considerably reduces the risk as opposed to investing in individual cryptoassets.

Active management

Active management is based on sound research and quantitative models. In such a young and dynamic asset class as cryptoassets, active management adds value by enabling the fund’s management to leverage market opportunities and manage risk.

Weekly liquidity

Shares in the fund are issued and redeemed weekly. This allows investors to manage their exposure to the asset class flexibly and dynamically according to their own risk preferences. Unlike many products available on the market, capital is not tied up on a long-term basis.

Key fund data

| ISIN-Nummer | LI0385769448 |

| WKN | A2JE79 |

| Mindestanlage | Keine |

| Liberierung | 18.04.2018 |

| Bewertungstag (T) | Mittwoch |

| Bewertungsintervall | wöchentlich |

| Valuta Ausgabe- und Rücknahmetag (T+2) | Zwei Bankarbeitstage nach Berechnung des Nettoinventarwertes (NAV) |

| Annahmeschluss Zeichnungen (T-1) | Vortag des Bewertungstages um spätestens 16.00 Uhr (MEZ) |

| Annahmeschluss Rücknahmen (T-2) | 2 Kalendertage vor dem Bewertungstag um spätestens 16.00 Uhr (MEZ) |

| Max. Ausgabeaufschlag | Keiner |

| Rücknahmeabschlag zugunsten des Teilfondsvermögens | Keiner |

| Max. Gebühr für Anlageentscheid, Risikomanagement und Vertrieb | 1.10% p.a |

| Max. Gebühr für Administration | 0.20% p.a. oder min. 25.000 CHF p.a. zzgl. 5.000 CHF p.a. pro Anteilsklasse ab der 2. Anteilsklasse |

| Max. Verwahrstellengebühr | 0.40% p.a. zzgl. 18.000 CHF p.a. |

| Performance-Fee | Keine |

Contact

If you have any questions please call +49 211 97633350 or write us: info@postera.io

Latest news

More importantinformation

Cryptoassets are a young and very dynamic asset class. The value of shares in the Postera Fund – Crypto I may, therefore, be subject to considerable fluctuations. The investment in crypto assets is highly speculative and risky and can result in the total loss of invested capital. Investments are only suitable for experienced investors who fully understand these risks. Investors interested in this asset class should conduct their own research and, if necessary, seek independent legal, financial and, if necessary, tax advice. A detailed description of the risks associated with an investment in Postera Fund – Crypto I and its investing activities can be found in the current fund prospectus.

With high return potential, low correlation and high liquidity, crypto assets are highly attractive alternative investments. However, in addition to their very high volatility, cryptoassets pose a number of other challenges for investors: Given that the asset class is still young, there is a lack of qualified analysts for cryptoassets and qualified staff for the management of crypto portfolios. Operational aspects – in particular, trading and custody of cryptoassets – are complex and require sound technical knowledge as well as investment in dedicated infrastructure and processes.

The Postera Fund – Crypto I is an Alternative Investment Fund (AIF) in the legal form of a trust pursuant to the Act on the Management of Alternative Investment Funds dated December 19, 2012, which implements the European AIFM Directive into Liechtenstein law. It is thus the first EU regulated fund that predominantly invests in cryptoassets. The fund is designed for professional investors seeking access to the asset class but do not want to bear the costs and risks of direct crypto investments. The fund enables investors to gain exposure to a diversified and actively managed crypto portfolio. Moreover, the fund is set up in a tax-efficient structure. The fund’s weekly liquidity allows investors to manage their exposure to the asset class dynamically.

- The fund invests in “blue chip” coins and tokens, which usually exceed a market capitalization of $1 billion.

- The investment universe of the fund currently consists of eight coins and tokens and is being continuously expanded.

- The portfolio of the fund is actively managed. As a result, opportunities in the market can be exploited and risks can be managed.

- Investment decisions are made on the basis of sound research. Among other things, the research is based on a proprietary scoring algorithm that takes into account an evaluation of the use case, the technical implementation, the regulatory environment and short-term market sentiment.

The fund is a collective investment scheme which has not been authorised or recognised by the Financial Conduct Authority in the United Kingdom. Accordingly, this document is not being distributed to, and must not be passed on to, the general public in the United Kingdom. This document is not to be distributed, delivered or passed on to any person resident in the United Kingdom, unless it is being made only to, or directed only at, persons falling within the following categories:

(i) Persons falling within the categories of “Investment Professionals” as defined in Article 19(5) of the Financial Services and Markets Act (Financial Promotion) Order 2005 as amended (the “FPO”), (ii) persons falling within any of the categories of persons described in Article 49(2) of the FPO (high net worth companies, unincorporated associations etc), (iii) persons falling within any of the categories of persons described in Article 50(1) of the FPO (sophisticated investors) or (iv) any other person to whom it may otherwise lawfully be made (all such persons together being referred to as “Relevant Persons”).

This Memorandum must not be acted on or relied on by persons who are not Relevant Persons.

Potential investors in the United Kingdom are advised that all, or most, of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the fund and that compensation will not be available under the United Kingdom Financial Services Compensation Scheme.

The information contained in this document is neither an offer nor a recommendation or a request to buy or sell shares in the fund or execute any other transactions. The document is for informational purposes only and does not constitute individual advice regarding an investment in shares in the fund or any other form of financial, strategic, legal or tax advice. Any statements or opinions expressed in this document are based on Postera Capital’s ubjective opinion as of the publishing date; this opinion can change at any time without prior notice. The exclusive basis for the acquisition of shares in the Postera Fund – Crypto I is the relevant prospectus and trust agreement, including – if applicable – updates and additions, as well as the most recent annual reports. You can obtain these documents in English language at IFM Independent Fund Management AG (Austrasse 9, FL-9490 Vaduz, Tel. +423 235 04 50, Fax +423 235 04 51 or Webseite: www.ifm.li).

Shares in the Postera Fund – Crypto I may only be offered or sold in jurisdictions in which such an offer or sale is permitted. Restrictions related to such offers or sales may apply. For example, shares in the Postera Fund – Crypto I may neither be offered or sold in the USA, nor directly or indirectly to US citizens or US residents.

Current key figures and performance can be found here.